Just two months after Meta invested a colossal $14.3 billion for a 49 percent stake in Scale AI and brought in its CEO, Alexandr Wang, to launch Meta’s Superintelligence Labs, serious fissures are emerging in the alliance. Scale executives—including Ruben Mayer—have already departed, while Meta’s TBD Labs are relying more on competitors like Mercor and Surge for AI data labeling, with researchers citing concerns over Scale’s data quality. Meanwhile, Scale AI laid off 200 full‑time employees and terminated hundreds of contractor roles, attributing the move to overexpansion and market shifts, even as partnerships with clients like Google and OpenAI dissolve in light of Meta’s heavy involvement. To make things worse, there’s been a serious data‑security scare—Scale AI reportedly stored sensitive corporate documents from Meta, Google, and others in publicly accessible Google Docs, prompting criticism and a rushed internal investigation.

Sources: Business Insider, San Francisco Chronicle, TechCrunch

Key Takeaways

– Executive turnover and vendor shifts: Key personnel (e.g. Ruben Mayer) have exited Meta’s AI initiative, and the team is relying on other data-labeling firms despite the massive Meta investment.

– Business fallout for Scale AI: Layoffs and client departures, including from OpenAI and Google, suggest the deal may have hollowed the startup‘s broader business.

– Security concerns: Improper handling of confidential documents in public platforms undermines trust and adds to the instability in the Meta–Scale AI partnership.

In-Depth

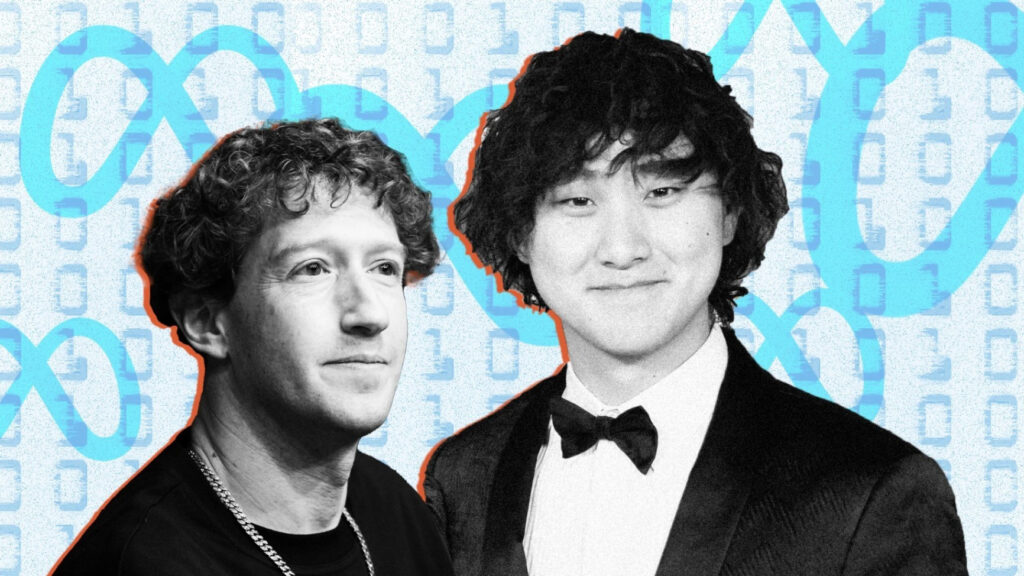

In June 2025, Meta dropped a staggering $14.3 billion on a near-50 percent stake in Scale AI, a move intended to super-charge its AI capabilities. The coup de grâce? Bringing in the startup’s charismatic founder, Alexandr Wang, to lead Meta’s newly formed Superintelligence Labs. Zuckerberg clearly bet that Wang’s leadership and Scale’s labeling infrastructure would anchor a breakthrough for Meta’s Llama models and broader AI ambitions.

Two months in, though, the honeymoon’s over. Executive departures—including Scale’s former GenAI product operations head, Ruben Mayer—underscore friction. Rumor has it that Mayer neither felt integrated into the core TBD Labs team nor reported to Wang directly. Meanwhile, Meta’s researchers are increasingly using data from Scale’s two biggest competitors: Mercor and Surge, citing higher quality labeling compared to Scale’s legacy crowdsourcing approach. For all its potential, Scale’s model chafes against the demands of next-gen AI.

The ripple effects extend well beyond Meta. OpenAI and Google, longstanding clients of Scale AI, have cut ties in response to the Meta deal, citing a loss of neutrality and concerns about future data integrity. This exodus has hit Scale’s bottom line—so seriously that it laid off 200 employees (14 percent of its workforce), scrapped hundreds of contractor roles, and restructured its generative AI teams. CEO Jason Droege called it a response to “over-expansion” and market shifts, but to outside observers, it feels like damage control.

Worse still, a damning security lapse emerged: confidential documents—including proprietary project details, pay records, and partner-specific manuals—from Meta, Google, and others were stored in publicly accessible Google Docs. That raised eyebrows and emergency audits across the tech world.

Taken together, these developments spell a cautionary tale. Even massive bets like Meta’s—hundreds of millions or even billions of dollars—can’t override culture clashes, logistical mismatches, or lapses in trust and quality. If Meta’s path to AI leadership relies on shaky alliances, the road ahead may be far rougher than anticipated.