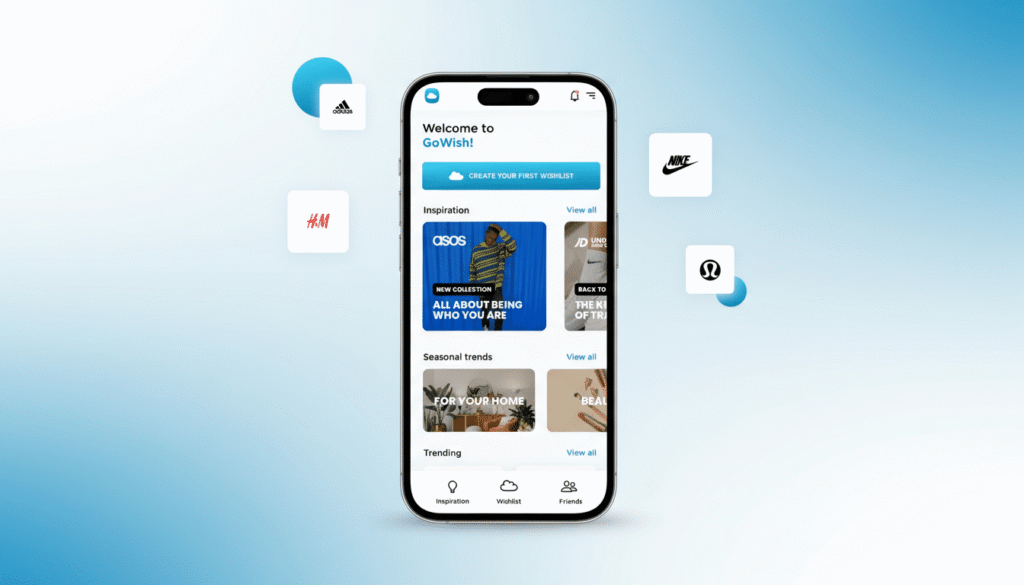

The wishlist-and-shopping app GoWish has reported its biggest year yet, registering over 13.6 million users globally and expecting hundreds of thousands of new daily sign-ups as the 2025 holiday season approaches. In the U.S. alone it counts nearly 6.2 million users, while in its native Denmark it boasts more than 3.5 million users — representing over 50 % market penetration. The app recently climbed to No. 2 on the U.S. App Store, defying recession-dragged consumer sentiment. Originally launched in 2015 by the Danish-Swedish postal service PostNord (as “Ønskeskyen”) and spun out into an independent tech firm after a 2020 acquisition, GoWish now operates with around 65,000 affiliate partnerships and over 700 brand integrations. The company turned a net profit after tax of US$1.7 million in fiscal year 2024, reinvesting earnings to fuel its global expansion and positioning itself as a rising player in “social shopping.”

Sources: TechCrunch, TechBuzz

Key Takeaways

– The rapid growth of GoWish underscores how niche shopping-tools and wishlist-platforms can capture meaningful global market share even in weak macroeconomic conditions.

– Profitability (US$1.7 million in net after-tax profit for 2024) suggests a business model that has moved beyond pure growth-at-any-cost, and is now monetising via brand/affiliate partnerships.

– The origin story (state-founded postal-service spin-out) plus strong penetration in its home market shows how regional successes can be leveraged for global scale in the tech-shopping space.

In-Depth

In a retail landscape marked by cautious spending and economic uncertainty, the performance of the app GoWish is noteworthy. Though many consumer-tech companies enter the holiday season with apprehension, GoWish is entering the 2025 year-end period with momentum. With a registered user base of over 13.6 million and surging daily sign-ups, the company is clearly benefiting from heightened interest in streamlined wish-listing, social sharing of gift ideas, and affiliate-driven shopping experiences.

The U.S. market alone accounts for nearly 6.2 million of those users, and its home country of Denmark sees over 3.5 million registered users—more than half the population. That level of market penetration provides a strong base from which to expand more aggressively abroad. The climb to No. 2 in the U.S. App Store identified the app’s breakout moment: this was not simply steady growth this year, but a leap in adoption, indicating that its business model is resonating with consumers.

How did GoWish reach this point? The platform began humbly as “Ønskeskyen,” a wish-list project inside the Danish-Swedish postal service PostNord back in 2015. From there it was spun out in 2020 after acquisition by Danish venture capital firm Dotcom Capital, led by founder and growth-officer Casper Ravn-Sørensen and CEO Mads Dahlerup. That kind of origin—moving from public service experiment to private scale-up—provides a distinguishing narrative in the tech world, and hints at a culture of frugality and operational discipline (traits more often found in European tech builds than in Silicon Valley hype-play starts).

The monetisation strategy is equally interesting. The firm reports having approximately 65,000 affiliate partnerships and more than 700 brand integrations where retailers embed “GoWish” buttons or otherwise tie into the app’s ecosystem. That affiliate network drives conversion from wishlist to purchase, enabling GoWish to capture value from the downstream shopping experience rather than purely from installs or ad revenue. And with a reported net after-tax profit of US$1.7 million in fiscal year 2024, the company demonstrates that growth is being accompanied by real financial results—not just user-metric vanity. Of course, that profit remains modest in absolute scale relative to large-scale consumer tech firms, but in the context of global roll-out, it is significant.

For creators and media professionals (such as yourself) who track digital-commerce trends, GoWish’s trajectory may provide a template of how “wishlist + social sharing + affiliate backbone” can serve as a viable business model. For example, users’ desire to centrally manage their gift ideas and share lists with friends and families is being monetised by converting those lists into purchase flows at retailers. Also, the international expansion strategy (strong home market, entry into English-speaking markets, leveraging digital advertising across Meta, TikTok, Snap, Google) underscores how consumer-tech growth now leans heavily on global scalability rather than the old U.S-first paradigm.

From a conservative-leaning perspective one might observe that GoWish’s model exemplifies market discipline and real consumer value: it’s not premised solely on endless rounds of funding and hyper-growth without business fundamentals. Instead, it grew from a modest origin, clarified its value proposition (wish-listing, discovery, sharing), built monetisation ties via affiliates, and is now scaling globally—with revenue and profit to show for it. That kind of business still aligns with principles of value creation and sustainable growth rather than speculative expansion.

However, scaling globally is never without risk. The affiliate-driven model requires maintaining strong relationships with partner brands and affiliate networks, while competition in the social-commerce and wishlist space could intensify (including from larger platforms expanding wish-list / gift registry features). There is also the question of how GoWish will continue to differentiate itself and maintain user engagement and growth in saturated markets such as the U.S. and U.K. As it moves into new territories, region-specific behaviours, regulations, and consumer expectations could also influence growth trajectories.

In short, GoWish’s record year is a notable case of a lean-built app hitting global velocity. If it continues to execute on its affiliate-platform strategy, maintain profitability, and expand into new markets with localisation and strong partnerships, it may become a more prominent name in the social-shopping ecosystem. For media producers, content creators and marketing strategists, this development also signals that next-generation commerce platforms may increasingly be about community, sharing and filtering (wish-listing) rather than pure transactional volume. That shift may present content opportunities around influencer-led wish-lists, gift-round-ups, affiliate-driven content, and consumer-habit insights heading into the 2025 holiday season and beyond.