Intel Corporation is showing signs of recovery after reporting a strong third quarter, yet the spotlight is now squarely on its foundry-business future as management acknowledges the unit remains a significant challenge. According to a TechCrunch article, Intel added about $20 billion to its balance sheet but offered scant detail on progress with its foundry operations. The company indicated that while other units are gaining traction, the foundry business — which manufactures chips for external customers — has under-delivered and is undergoing a strategy reset. Additional coverage from Yahoo Finance underlines this narrative, noting the foundry arm still lacks a clear path even as the broader turnaround begins to resonate. Meanwhile, Tom’s Hardware reports that Intel returned to profitability in Q3 2025 with revenue of $13.7 billion and net income near $4.1 billion, yet its foundry segment declined slightly to $4.2 billion in revenue and still posted a roughly $2.3 billion loss. Against a backdrop of strong market demand for chips and reshoring efforts in U.S. manufacturing, Intel’s foundry business is emerging as the pivotal piece in determining whether the recovery sticks.

Sources: Tom’s Hardware, TechCrunch

Key Takeaways

– Intel is successfully initiating a broader operational recovery, returning to profitability in Q3 and strengthening its balance sheet.

– The company’s foundry business remains a weak link: revenue fell slightly and losses persist, prompting investor and industry focus on its future direction.

– Given the U.S. strategic emphasis on semiconductor manufacturing and reshoring, Intel’s ability to scale its foundry operations will be critical for sustaining its turnaround and long-term competitiveness.

In-Depth

Intel’s Q3 2025 results mark a welcome turn for the once-flagging chip giant. With revenue of about $13.7 billion and net income around $4.1 billion, the company has demonstrated that cost cuts, asset sales and improved execution can move the needle. Meanwhile, the injection of roughly $20 billion into its balance sheet offers stronger liquidity and operational flexibility. Yet despite these encouraging signs, the spotlight has shifted to a section of the business where Intel still has far to go: its foundry division.

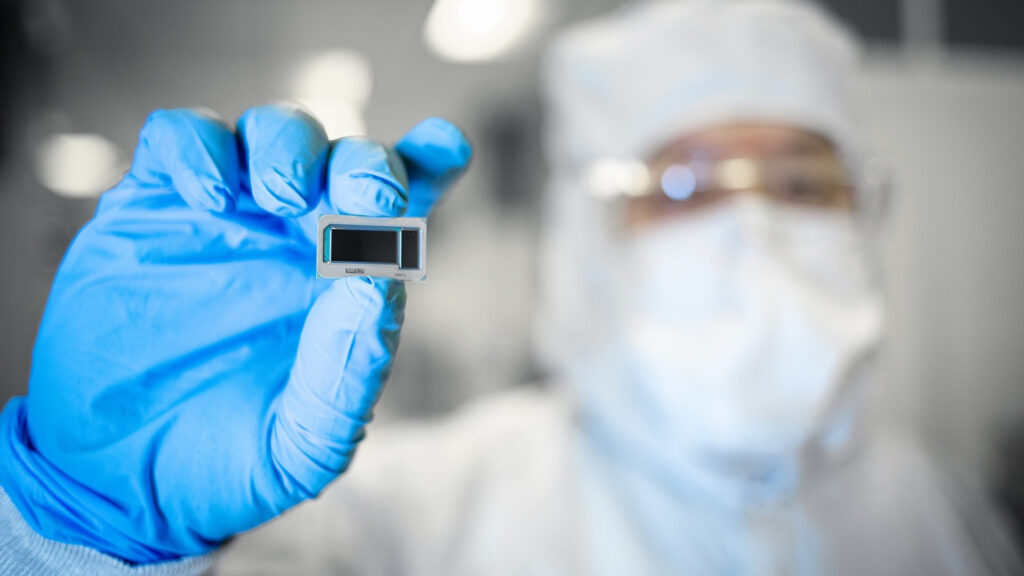

The foundry business, which entails manufacturing chips not only for Intel itself but for external clients, remains under intense scrutiny. In the recent quarter, Intel’s foundry revenue stood at about $4.2 billion—a slight drop quarter-over-quarter—and it still posted losses on the order of $2.3 billion. This division has been historically difficult for the company. As reported, Intel offered limited clarity in its latest filings and commentary about how it plans to scale this unit profitably or secure large foundry-customer commitments. Given the capitulation of the broader semiconductor industry to enormous capital expenditures and tight yields, Intel’s foundry rollout cannot be treated as a side project.

From a strategic standpoint, Intel’s foundry aspirations matter on multiple levels. First, the semiconductor ecosystem is increasingly dominated by companies like Taiwan Semiconductor Manufacturing Company (TSMC), which serve as the global foundry leader. Intel’s ambition to operate a competitive foundry business not just for internal use but for third-party clients is a significant departure and poses steep challenges: process yield, capital intensity, customer acquisition and trust all come into play. Second, geopolitical dynamics raise the stakes: the U.S. government views domestic chip manufacturing capability as a matter of national security and has tied subsidies and initiatives to maintaining foundry operations stateside. For Intel, this means its turnaround is not simply a corporate matter but part of a broader industrial policy equation.

Management appears to recognize the seriousness of the task. The company has publicly declared that building a world-class foundry business is a “long-term effort founded on trust,” emphasising customer satisfaction, yield, cost and schedule discipline. It is moving toward offering its manufacturing services to a wider array of external clients, aiming to convert capacity into revenue beyond its own chip output. But the path remains risky: yields for newer process nodes remain uncertain, competition is intense, and prior delays and mis-steps have eroded some of the goodwill and credibility Intel would like from prospective foundry customers.

In the context of the turnaround, this means that while Intel’s core operations are improving, the foundry business serves as a potential inflection point. If Intel can successfully execute and scale this unit, it could unlock multi-year growth and justify the turnaround narrative. On the other hand, if foundry losses persist or customers fail to commit, the recovery may prove brittle, exposing the company to renewed criticism.

For investors, industry watchers and policymakers, the implications are clear: the turnaround is real—but incomplete. The near-term financials show promise, yet the longer-term viability hinges on the foundry business hitting key milestones: securing major clients, ramping yields and turning to profitability at scale. For Intel, this is where the rubber meets the road.