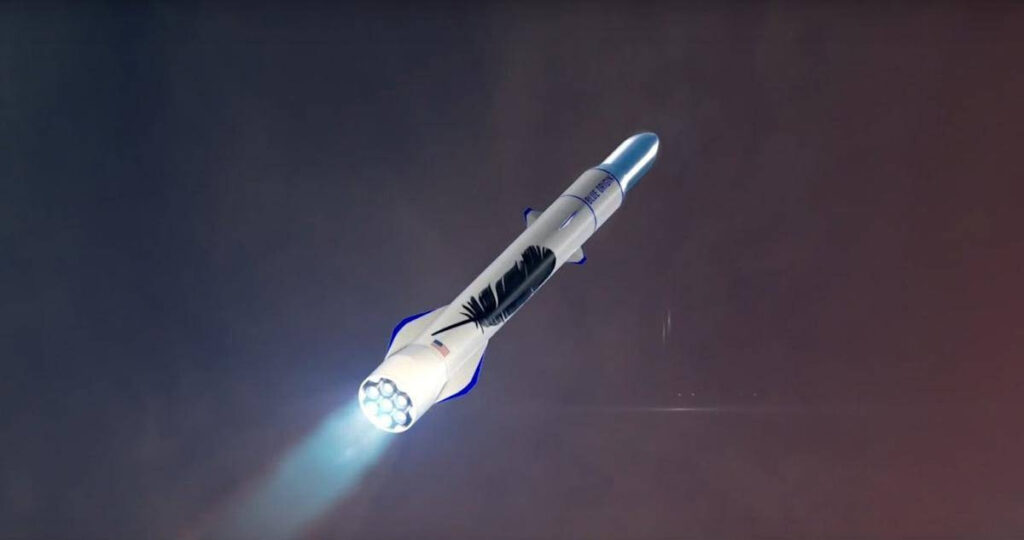

Blue Origin, the aerospace company founded by Jeff Bezos, has officially announced TeraWave, a massive new satellite communications network designed to compete with Elon Musk’s SpaceX and its Starlink constellation by providing ultra-high-speed, enterprise-grade internet service from space. TeraWave plans to deploy 5,408 satellites in multi-orbit configurations — including low Earth orbit (LEO) and medium Earth orbit (MEO) — to deliver global coverage with data throughput approaching up to 6 terabits per second (Tbps), positioning the network as a competitor for data centers, governments, and large commercial clients rather than traditional consumer broadband. Although TeraWave will still be smaller than Starlink’s existing constellation of roughly 9,400 satellites, the initiative marks a major escalation in the orbital broadband race and reflects growing billionaire-led competition in space infrastructure. Deployment is slated to begin in the fourth quarter of 2027, with Blue Origin leveraging its New Glenn rocket for launches and emphasizing optical inter-satellite links and redundant broadband connectivity across remote and strategic markets. In addition to rivaling Starlink, TeraWave complements Amazon’s rebranded Leo satellite initiative — another space-based internet effort that targets consumer and business markets — highlighting a broad push by U.S. companies to dominate global satellite connectivity amid rising demand for high-capacity communications services. Sources indicate that China is also accelerating its own satellite constellations, intensifying global competition in LEO broadband connectivity.

Sources:

https://www.semafor.com/article/01/22/2026/blue-origin-to-launch-satellite-network-to-rival-starlink

https://www.reuters.com/science/bezos-blue-origin-deploy-thousands-satellites-new-terawave-communications-2026-01-21/

https://www.theverge.com/news/865282/blue-origin-terawave-satellite-6tb

Key Takeaways

- Blue Origin’s TeraWave is positioned as a high-capacity enterprise satellite internet network, designed to serve data centers, governments, and large commercial clients with symmetrical speeds up to 6 Tbps, differentiating it from consumer-focused services.

- Deployment is targeted for late 2027 with a constellation of 5,408 satellites, placing Blue Origin in direct competition with Starlink, even as it remains smaller in scale but more specialized in service.

- The announcement heightens competition in global satellite broadband, including U.S. corporate rivals like SpaceX and Amazon’s Leo, as well as emerging international efforts, signaling a crowded and strategically important segment of space infrastructure.

In-Depth

Blue Origin’s announcement of TeraWave represents a calculated gambit to break into the satellite broadband market dominated for years by SpaceX’s Starlink. Rather than simply recreating Starlink’s consumer-oriented model, Blue Origin has taken a more strategic approach, focusing on enterprise, government, and data-center clients that demand extreme data throughput, symmetrical connectivity, and robust redundancy. At the core of TeraWave’s strategy is its multi-orbit architecture: thousands of satellites in both low Earth orbit (LEO) and medium Earth orbit (MEO) that work together to provide a mesh of high-capacity optical and radio links around the globe. This design allows Blue Origin to offer raw bandwidth at rates approaching 6 terabits per second — *orders of magnitude above typical residential broadband speeds and significantly ahead of most existing satellite networks. By relying on optical inter-satellite communication and high-bandwidth backhaul, TeraWave targets a niche where traditional terrestrial fiber is expensive, slow to deploy, or unavailable, especially for remote or strategic applications requiring secure, large-scale connectivity.

The TeraWave constellation is slated to begin deployment in late 2027, a timeline that underscores Blue Origin’s confidence in its New Glenn launch vehicles and orbital infrastructure capabilities. While Starlink already has a commanding presence in LEO with thousands of satellites and millions of individual users, TeraWave’s emphasis on institutional customers could carve out a complementary — rather than purely direct — competitive segment. This approach also dovetails with broader industry trends: as artificial intelligence, cloud computing, and real-time data analysis grow more central to national security and commercial operations, demand for ultra-low-latency, high-bandwidth connections in every corner of the globe is intensifying.

At the same time, the battle for orbital connectivity is becoming more crowded. Amazon’s Leo project and various international satellite constellations are entering the fray, and regulatory challenges like frequency allocation and orbital traffic management are becoming strategic battlegrounds. TeraWave’s technical ambitions and targeted market positioning highlight not just a technological rivalry between Jeff Bezos and Elon Musk, but a broader shift toward viewing space as a critical infrastructure domain that extends far beyond consumer internet access and into the core of global communications, economic power, and national competitiveness.