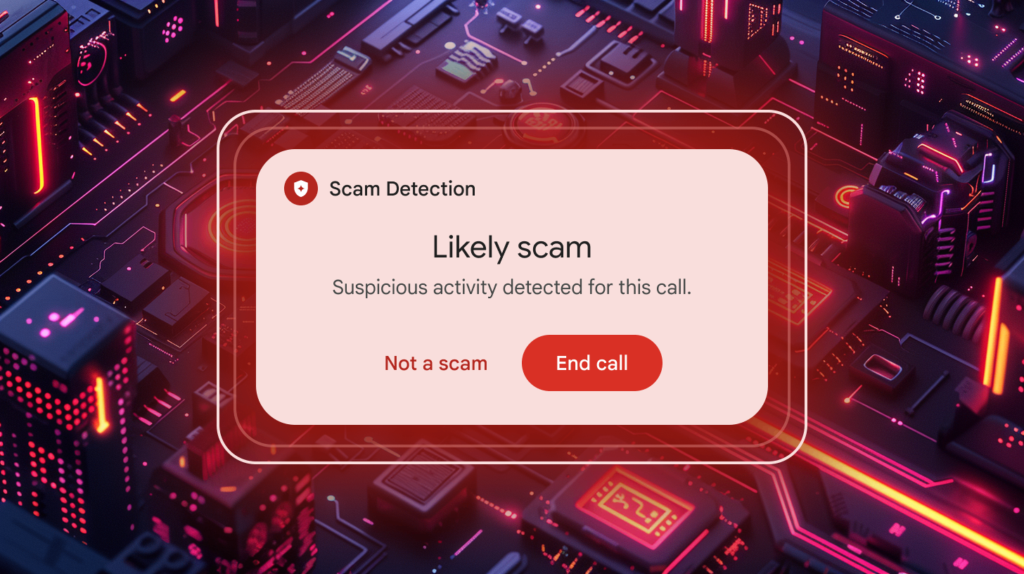

Android is rolling out new in-call scam protection in the United States. When users open a supported financial app — such as a banking or payment app — while on a call with an unsaved number and sharing their screen, Android will display a warning and force a 30-second pause before proceeding. The alert also offers a one-tap option to end the call, interrupting the pressure tactics scammers often use to rush users into unsafe banking or money-transfer actions.

Sources: Android Authority, The Verge

Key Takeaways

– Android’s new feature targets scams where callers persuade victims to share their screen and access banking or fintech apps — adding friction (a 30-second pause) to disrupt scam pressure tactics.

– The rollout includes major apps like Cash App and banks such as JPMorgan Chase, reflecting collaboration between Android and prominent financial institutions.

– This builds on prior Android protections that block risky actions — like sideloading apps or granting permissions — during calls, broadening defense against evolving social-engineering and fraud threats.

In-Depth

Scammers have grown more cunning: instead of relying solely on robocalls or phishing links, many now impersonate banks or payment services while engaged in a voice call, urging victims to “share their screen” and then guiding them to transfer money or surrender sensitive credentials. To combat this, Android is introducing a proactive safety net, designed to catch these scams in real time — before the user hands over control of their device.

Under the new system, if you launch a supported financial or fintech app while on a call with an unknown number and screen sharing is active, Android triggers a full-screen warning. The precaution pauses the action for 30 seconds, giving you time to think clearly rather than acting on impulse under a surge of fear or urgency — a common emotional lever used in scams. It also presents a clear, one-tap “End call now” button, cutting off contact with the likely scammer immediately.

This isn’t Android’s first move against scam calls. Earlier in 2025, Android 16 — and compatible devices — blocked risky behavior like sideloading apps or granting accessibility permissions during active calls, something scammers frequently request to gain deep access to a phone. With this new anti-screen-sharing protection, the platform closes off yet another scam vector.

By partnering with major banks and financial apps — such as Cash App and JPMorgan Chase — Android ensures that the protections cover services many U.S. users rely on every day. The move acknowledges how real the screen-sharing scam threat has become, especially given how easily fraudsters can spoof caller IDs or use voice-over-IP calls to impersonate legitimate institutions.

From a conservative security perspective, this rollout shows a smart balance between user convenience and safety: rather than invading privacy with always-on monitoring or storing call content, Android handles scam detection directly on the device and only intervenes when potentially risky behavior (screen sharing during a call + launching a bank app) occurs. By building in friction — the 30-second pause and a stark warning — Android subtly restores the kind of hesitation and caution users might naturally feel when confronted with financial requests.

In short: if you use an Android phone and do online banking or payments while on calls, this feature could save you from a scam that feels legitimate. It won’t replace common sense, but it adds a guardrail—making it harder for fraudsters to succeed purely on manipulation and urgency.