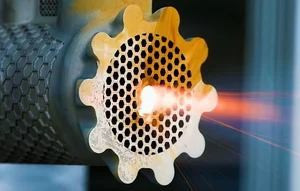

Arbor Energy, the startup founded by former SpaceX engineers, initially pitched its power-plant technology—which converts biomass into syngas and then burns it under a pure‐oxygen regime—as a “vegetarian rocket engine” for the grid. According to recent coverage, Arbor has now admitted that the plant will not rely solely on biomass (plant waste) as fuel, but will also burn natural gas to satisfy the massive, growing electricity demands of data centres and AI infrastructure. This pivot signals a pragmatic shift: while still pursuing lower-carbon possibilities, Arbor is essentially acknowledging that the supply of biomass or the consistency of its output cannot yet match the scale and reliability needs of large commercial data-centre operators.

Sources: Yahoo Finance, intelME

Key Takeaways

– Arbor’s original pitch of a purely biomass-fueled “rocket engine” for power generation is being modified to include natural gas, highlighting practical scale and reliability challenges in renewable fuel supply.

– The data-centre and AI-infrastructure power-demand boom is forcing companies like Arbor to compromise on purity of the “green” fuel model in favour of hybrid strategies that ensure uninterrupted, cost-effective service.

– This shift underscores how many so-called “clean-tech” innovations may require transitional reliance on conventional fuels before fully realising their original, more-sustainable vision.

In-Depth

Arbor Energy came out of the gate with an ambitious vision: repurpose waste biomass—think agricultural residues, wood chips, plant by-products—convert that into a high-energy syngas under oxygen-rich conditions, and then burn that gas in a kind of “rocket engine” style turbine or combustion chamber to generate power for large scale loads such as data centres. This was the “vegetarian rocket engine” angle: plant-based fuel only, minimal or zero fossil-fuel usage, a bold statement in an age of decarbonisation. However, more recent reporting makes clear that Arbor is now shifting into what could be described as an “omnivore” mode: they will supplement biomass with natural gas to meet the reliability and scale demands of their customers. The article from TechCrunch makes this pivot explicit, and supporting coverage from Yahoo Finance corroborates the broader industry narrative.

What’s behind the shift? On one hand, biomass is inherently variable: supply chains are more complex, feedstock quality can fluctuate, and energy density often lags that of fossil fuels. Even with sophisticated conversion technology, a power-plant operator cannot afford frequent failure, interruptions, or output mismatches—especially when serving mission-critical infrastructure like data centres or AI workloads. On the other hand, natural gas provides a proven, high-reliability path to large, consistent power output. The hybrid approach enables Arbor to promise both scale and reliability, which may make it more commercially viable in the near term—even if it moves the company away from a purely plant-based fuel narrative.

From a conservative, market-pragmatic standpoint, this is a smart move. Technology companies face investors and clients that demand uptime, cost-control, and clear ROI—not just sustainability rhetoric. Arbor’s decision suggests a recognition that while the long-term goal of entirely renewable fodder remains valid, the current technology and infrastructure ecosystem may require bridging with fossil fuels to deliver at scale. For investors, this could imply that rather than bet on a “pure” green play with uncertain delivery timelines, a hybrid or transitional model might offer a more realistic path to revenue and growth.

What are the implications? First, the carbon-intensity story gets murkier. If natural gas is in the mix, then the emissions profile is not purely biomass-offset, and customers and regulators will need transparency on what portion of fuel is fossil-derived. Secondly, companies that pitched “100 % renewables” might find their supply chains and business models under stress when scaling, which means market players and policymakers need to temper expectations around what is commercially viable now. Thirdly, for you (given your interest in infrastructure, real-estate and the hidden costs of large projects), this move signals that the energy supply side for data centres and similar high-demand facilities remains a risk area: assumptions of “clean” power may need to be revisited, and hybrid fuel risk may need to be factored into project modelling, landlord responsibilities, and regulatory compliance.

In short, Arbor’s pivot from “vegetarian” to “omnivore” in its power-plant fuel strategy is a sober acknowledgment of the practical realities of commercial-scale electric generation. It doesn’t mean the green goals are abandoned—just that they’re being re-scoped under more realistic constraints. Monitoring how much natural gas is used, how the biomass feedstock chain evolves, and what the emissions and cost outcomes are will be important as this and similar projects scale up.