In a notable strategic shift, Intel Corporation has officially removed its planned mainstream 8-channel memory version of the next-generation Xeon server chips—codenamed “Diamond Rapids” (8 CH variant)—from its roadmap, while retaining the 16-channel version aimed at high-end data centers. According to reporting by ServeTheHome, Intel issued a statement saying: “We have removed Diamond Rapids 8CH from our roadmap. We’re simplifying the Diamond Rapids platform with a focus on 16 Channel processors and extending its benefits down the stack to support a range of unique customers and their use cases.” The decision comes amid growing pressure from competitors such as Advanced Micro Devices, Inc. (AMD) in the server-CPU arena and concerns over Intel’s dual‐platform strategy, which had included an 8-channel mainstream platform alongside a 12/16-channel high-end variant. Industry commentary suggests the move underscores Intel’s urgency in stabilizing its data‐center CPU business, refocusing resources on fewer variants and higher margins.

Sources: Serve the Home, CRN.com

Key Takeaways

– Intel’s cancellation of the 8-channel version of Diamond Rapids signals a consolidation of its server CPU roadmap, focusing solely on higher-capacity 16-channel designs.

– The move can be interpreted as a response to competitive pressure (especially from AMD) and internal challenges—Intel appears to be prioritizing performance and margin over broad product breadth.

– For enterprise and OEM customers, this creates immediate implications: fewer entry‐level server CPU variants from Intel, potential platform cost shifts (motherboards/memory), and perhaps accelerated consideration of alternative solutions (including AMD or Arm‐based servers).

In-Depth

Intel’s decision to remove the 8-channel mainstream variant of its upcoming Diamond Rapids server processor represents a significant pivot in the company’s data-center strategy—and one that conservative observers might view as a pragmatic, if overdue, realignment of focus. Under the leadership of the company’s new Data Center Group executive, Intel has acknowledged that running a dual-platform (8-channel + 16-channel) server roadmap no longer makes sense in today’s environment; hence the official statement: “We have removed Diamond Rapids 8CH from our roadmap. We’re simplifying the Diamond Rapids platform with a focus on 16 Channel processors and extending its benefits down the stack to support a range of unique customers and their use cases.”

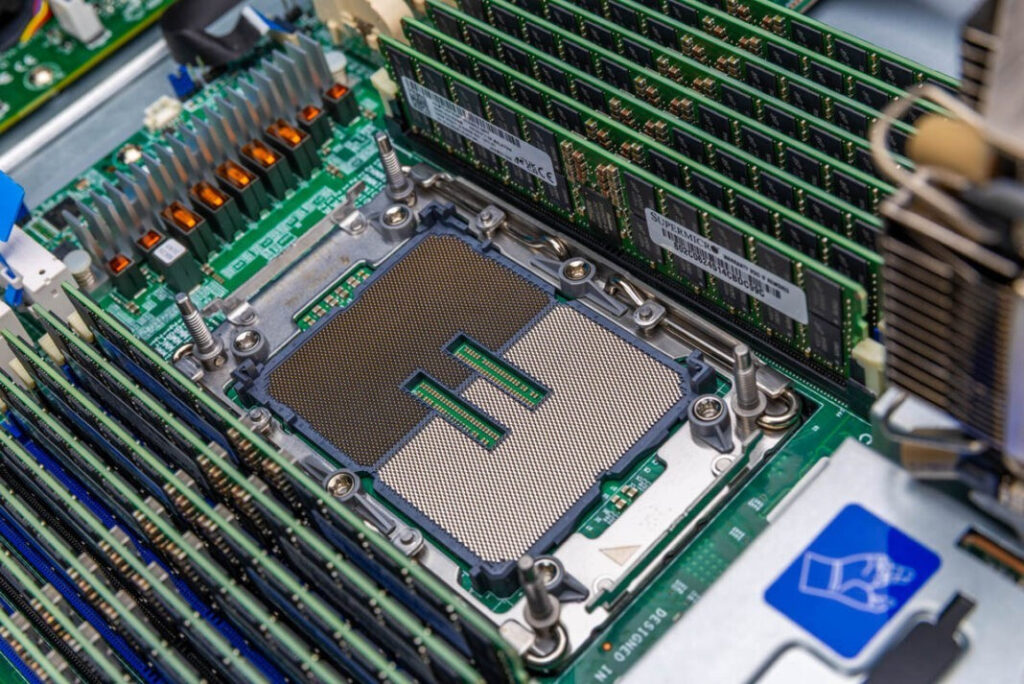

There are two big themes at play. First, the 16-channel variant—traditionally reserved for high-end servers or AI/ML clustering—is now being positioned as the backbone of Intel’s next-gen server strategy. By eliminating the 8-channel variant, Intel is effectively narrowing its product lineup and doubling down on higher-throughput, higher-cost solutions. That means higher memory-bandwidth, more DIMM slots, and a platform skewed toward bigger, more expensive server builds. For enterprises seeking lower-cost, mainstream server CPUs, this could push them toward alternative architectures or higher-end footing. Indeed, the 8-channel design had been popular because it allowed lower-cost motherboards, fewer memory slots, and cheaper overall system occupancy—features highlighted in the ServeTheHome analysis.

Second, Intel is under mounting pressure: its server CPU share has been slipping, and competitors are gaining ground. According to CRN, Intel now faces an urgency to stabilize its data-center CPU business or risk further erosion.

By simplifying its roadmap, Intel may be trying to avoid the pitfalls of legacy product fragmentation, cost overruns, and slipping behind rivals who are growing faster with fewer variants and cleaner value propositions. For conservative stakeholders—those who expect fiscal discipline, streamlined product lines, and focus on profitability—this move aligns with sound strategic trimming: fewer SKUs, less internal complexity, and clearer go-to-market messaging.

Of course, there will be implications for the broader enterprise ecosystem. OEMs and server vendors who built around the 8-channel version may need to revise their designs or absorb cost increases associated with upgrading to the 16-channel platform. From a budgetary standpoint, lower-cost server builds may see an uptick in cost or have to accept older generations for a longer duration. On the flip side, Intel’s refocus may invite customers who are already pushing toward denser compute/AI workloads to commit sooner to the 16-channel path, perhaps accelerating deployment of next-gen servers powered by Intel’s architecture.

In sum, this is a company-level strategic contraction: Intel is shedding a mainstream variant to sharpen its competitive posture, concentrate design resources, and push heavier business toward premium segments. For the conservative technologist or enterprise buyer, the takeaway is clear: plan for a world where Intel’s near-term server roadmap is less broad but more concentrated, and potentially more expensive in the entry segment. If this gamble pays off—if the 16-channel Diamond Rapids platform delivers on performance, yield, cost and competitiveness—it may restore market momentum. If not, Intel could risk ceding further ground to AMD or other challengers.