General Fusion, the Canadian magnetized-target fusion developer, announced that it secured a critical US $22 million funding infusion from existing backers in a “pay-to-play” round, including Segra Capital, PenderFund, Chrysalix, Gaingels, Hatch, MILFAM, JIMCO, Presight, and Thistledown; Segra and PenderFund also gained board seats. The boost comes after a painful 25 percent staff layoff in May and falls far short of the roughly US $125 million the company had sought, but it provides a few precious months to advance its LM26 fusion demo machine toward key technical benchmarks. Before this round, General Fusion had raised around US $440 million since its 2002 founding.

Sources: ElectronicsForYou.biz, Globe Newswire, TechCrunch

Key Takeaways

– The $22 million is structured as a “pay-to-play” round—existing investors must participate to maintain their ownership—a signal of cautious confidence amid financial strain.

– With this nearly modest capital infusion, the company aims to push its LM26 demonstration milestone, though it still faces a large funding gap to stay on track.

– General Fusion’s total raised prior to this was already substantial—roughly $440 million—but the new amount underscores the capital-intensive and high-risk nature of commercializing fusion energy.

In-Depth

General Fusion’s latest $22 million lifeline underscores how tough the fusion energy race remains—especially for firms chasing one of science’s most elusive prizes. This funding doesn’t get the company back to breathless optimism, but it does buy them more runway toward key technical milestones. The financing comes from a clutch of committed backers, ranging from Segra Capital and PenderFund (both earning board seats) to Gaingels, Chrysalix, JIMCO, Hatch, MILFAM, Presight, and Thistledown. It’s structured as “pay-to-play,” meaning investors had to ante up to stay in the game. That’s not a strong vote of confidence, but it isn’t a dagger either—it’s more like a cautious handshake.

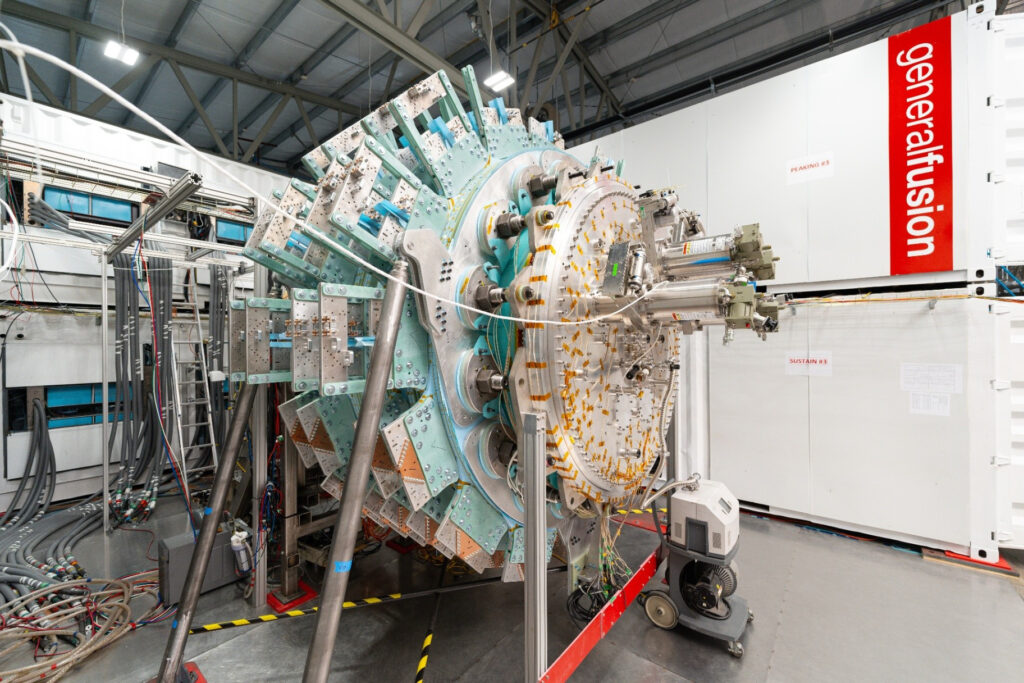

Contrast this with the $125 million the startup had hoped to raise, and the message is clear: General Fusion is not out of the woods, but they’re kicking forward. Back in May they trimmed 25 percent of their workforce amid financial pressures and public appeals for support. The LM26 test machine, central to their magnetized-target fusion approach, needs more development to hit temperatures high enough to reach scientific breakeven. The new funds likely keep the lights on and the pistons firing for a while longer.

Look back at the broader context: fusion firms globally have pulled in billions, fuelled by breakthroughs and big ambitions—but each step remains staggering in cost and complexity. General Fusion has raised about $440 million historically, which is nothing to scoff at, yet still leaves them vulnerable. The real test now is clear: deliver hard technical progress—or risk running out of both time and money.