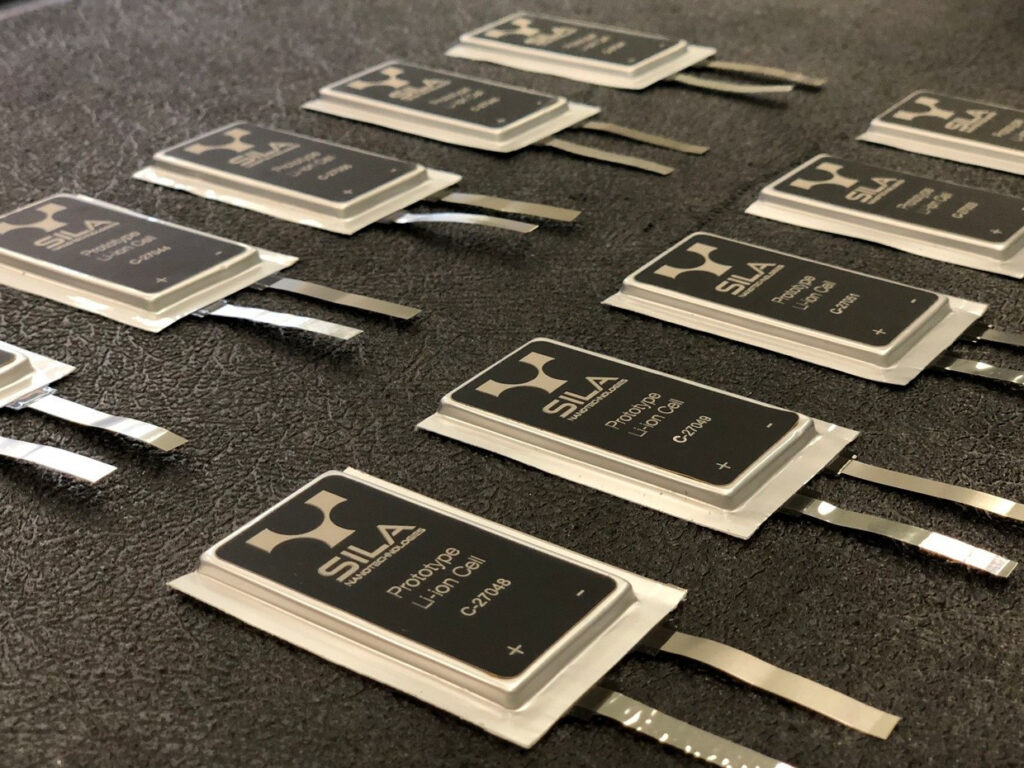

Sila, the battery materials startup, officially commenced operations at its new facility in Moses Lake, Washington, marking what it calls the first large-scale silicon anode plant in the Western hemisphere. The factory is projected to support materials production for 20,000 to 50,000 electric vehicles initially and has potential to scale up to meet demand for 2.5 million vehicles over time. Sila already has supply agreements with Panasonic and Mercedes, and views this move as a key step toward domestic sourcing of advanced battery materials and enhancing U.S. competitiveness in the global battery race. Concurrently, competitors like Group14 and Amprius are making strategic moves: Group14 recently raised $463 million to expand production and consolidate its global footprint, while Amprius has secured multi-million dollar orders and is ramping up its silicon anode platform for drones and EVs.

Sources: GeekWire, Amprius Technologies

Key Takeaways

– Sila’s Moses Lake factory is positioned as a milestone in U.S. efforts to build a domestic supply chain for next-gen battery materials.

– Massive capital flows into silicon-anode startups like Group14 and Amprius underscore investor confidence in this technology’s role in EV and drone markets.

– Challenges remain around scale, cost competition (especially from Chinese graphite supply), and the technical hurdles of silicon anode durability and integration.

In-Depth

In the evolving landscape of electric vehicles, battery technology continues to be a defining battleground. Traditional lithium-ion cells generally rely on graphite for the anode, but silicon offers the promise of significantly higher energy density (in some designs, up to ten times greater theoretical capacity). That said, silicon also faces well-documented challenges—mechanical stresses from volume expansion, cycling degradation, and cost of manufacturing have limited its mainstream adoption so far.

Sila’s move to open a full-scale silicon anode plant in Moses Lake is a bold attempt to bridge the gap from lab promise to mass manufacturing. The location offers favorable conditions like low-cost hydroelectric power and access to key raw materials, which the company believes will help drive down costs and improve process reliability. In the short term, the factory is expected to service tens of thousands of EVs, but its real strategic importance lies in scaling—if Sila can ramp production toward automotive volumes, it could shift supply chains that today depend heavily on overseas graphite mines and refining.

The competitive environment is heating up. Group14, a well-known player in silicon-carbon composite anodes (SCC55), recently closed a $463 million Series D financing round and acquired full control of its joint venture factory in South Korea, signaling aggressive expansion and vertical integration. Meanwhile, Amprius—founded on silicon nanowire anode technology—has locked in multi-million dollar orders from drone manufacturers and is actively pushing its SiCore platform. Their Q2 2025 financials show revenue growth and growing commercial traction, suggesting their technology is inching closer to viability.

Yet there are headwinds. Chinese graphite producers benefit from scale, favorable regulations, and cost structures that are difficult to beat. Moreover, while silicon’s energy gains are compelling, making it survive hundreds or thousands of charge cycles reliably in real-world EV usage remains an engineering hurdle. Success will rest not just on novel materials, but on manufacturing consistency, supply chain resilience, and cost control.

Still, the timing is significant. The U.S. is placing greater strategic emphasis on domestic critical materials, clean energy, and supply chain sovereignty. The Biden administration, bipartisan infrastructure initiatives, and climate goals all create a favorable policy backdrop for domestic battery technology. If Sila and its rivals succeed, it could reshape the balance of power in EV supply chains. But that’s a big “if.” The coming years will test whether silicon anodes evolve from promising lab chemistry into the backbone of next-generation mobility.