Deep Fission, a Berkeley-based nuclear startup led by Elizabeth and Richard Muller, has executed a curious reverse merger with Surfside Acquisition Inc. to go public via the OTCQB market. The company raised $30 million through an oversubscribed private placement priced at $3 per share—significantly below the typical $10 SPAC level—to fuel development of its innovative “borehole reactor” concept. These compact 15 MW pressurized-water reactors are designed to be lowered into 30-inch wide boreholes drilled one mile underground, offering natural shielding and enhanced safety while serving as reliable power sources for energy-hungry data centers. Selected for the Department of Energy’s Reactor Pilot Program, Deep Fission targets reactor criticality by July 2026. However, the modest financing, public reporting obligations, and narrow investor pool raise questions about the company’s ability to scale in the costly and heavily regulated nuclear industry.

Sources: Business Wire, Bloomberg, TechCrunch

Key Takeaways

– Innovative safety-first design: Deep Fission’s underground borehole reactors offer natural shielding and a reduced surface footprint, potentially lowering safety concerns associated with traditional nuclear plants.

– Modest capital for an ambitious goal: While the $30 million raise provides runway for prototype development, it’s modest relative to the capital-intensive nature of nuclear projects—a concern for long-term viability.

– Public exposure with constrained upside: Going public via an OTCQB reverse merger priced at $3 may deliver transparency but limits investor appeal and liquidity compared to traditional $10 SPAC listings.

In-Depth

Deep Fission is making a bold move in the nuclear space, and it all starts underground—literally. The Berkeley-based startup, spearheaded by Elizabeth and Richard Muller, is tackling long-standing safety and security concerns by designing small, 15-megawatt reactors to be installed a full mile beneath Earth’s surface.

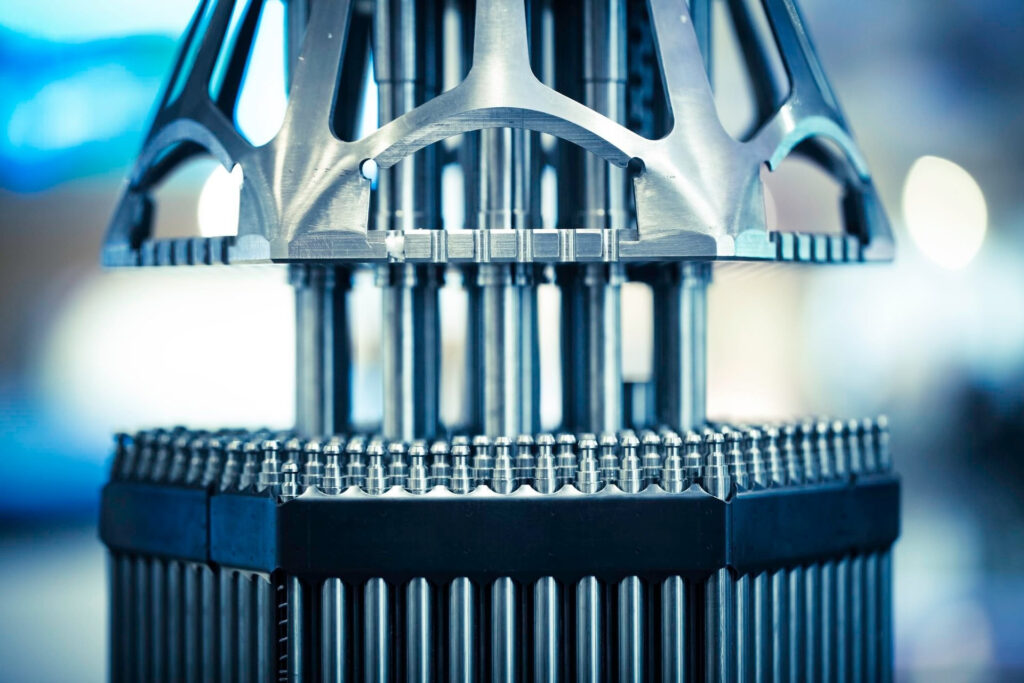

The concept hinges on natural geology: by lowering pressurized-water reactors—similar to those used in submarines—through 30-inch boreholes, the company hopes to minimize meltdown hazards and shield operations from external threats, all while appealing to energy-hungry data centers looking for secure, baseload power.

To get this project off the ground, Deep Fission recently secured $30 million in a heavily oversubscribed private placement priced at just $3 per share—well below typical SPAC pricing. This capital was tied to a reverse merger with Surfside Acquisition Inc., allowing the startup to trade on the OTCQB market. The public listing brings regulatory transparency and some credibility, but the low price and narrow investor base may constrain upside and limit liquidity.

Still, with inclusion in the Department of Energy’s Reactor Pilot Program, Deep Fission aims to achieve reactor criticality by July 2026. That’s ambitious—and necessary—given the modest cash buffer against the steep costs of nuclear development and the stringent regulatory environment. At a time when AI data centers are driving intense demand for reliable, low-carbon energy, Deep Fission’s underground approach is both timely and provocative.

Success will hinge on execution, regulatory navigation, and securing follow-on funding. For now, the industry—and investors—are watching cautiously optimistic.