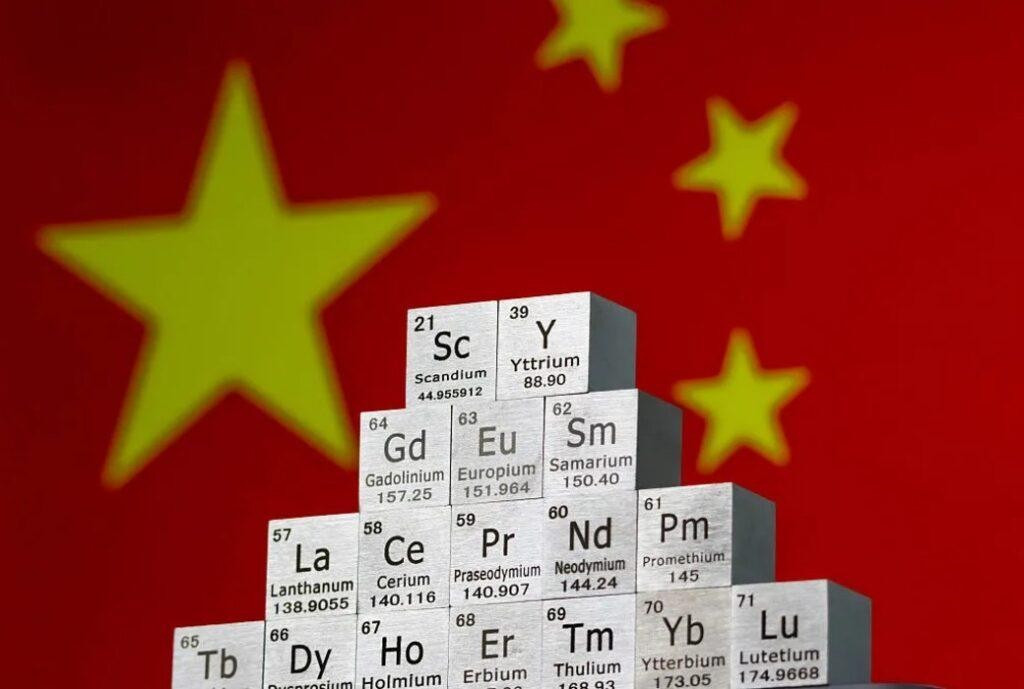

In a surprise shift in the ongoing U.S.–China trade tensions, the White House announced that China will suspend several key export controls on rare earth minerals and related materials, effectively reversing earlier restrictions implemented by Beijing in April 2025 and October 2022. According to the fact sheet released by the White House, China has agreed to resume issuing general licences for the export of rare earths, gallium, germanium, antimony and graphite to U.S. end-users and their global supply chains. TechCrunch reports this as a meaningful concession given China’s dominant role in critical minerals. At the same time, previous analyses by Reuters and Associated Press highlight that while this development offers a reprieve for U.S. manufacturing, it does not guarantee a lasting structural shift in China’s leverage over global supply chains—a dynamic that remains strategically fraught.

Key Takeaways

– China’s willingness to suspend its export controls signals a tactical concession in the trade battle, giving the U.S. breathing room for critical minerals used in defence, electronics and EV supply chains.

– Despite the apparent rollback, analysts caution that China’s fundamental dominance over rare earth mining, refining and processing remains intact, meaning the structural risk to U.S. supply chains is still real.

– The deal underscores the strategic importance of rare earths in both economic and national-security terms and may represent a short-term “window” for U.S. and allied firms to diversify supply chains before China potentially reasserts control.

In-Depth

The recent announcement by the White House that China will suspend key export controls on rare earth minerals marks a noteworthy development in the ongoing tug-of-war over global supply chains and strategic manufacturing. For years, China has held a near-monopoly over the processing and export of rare earth elements—vital materials for everything from electric vehicle batteries and wind turbines to jet engines and radar systems. According to previous reporting, China accounts for about 90 % of the world’s refined rare earth supply.

In April 2025, Beijing imposed sweeping export restrictions on a wide range of rare earths and related items, in response to U.S. tariffs. The move sparked concerns across global auto, electronics and defence sectors about supply disruptions and surging prices. Reuters data indicated exports of rare earth magnets to the U.S. plunged significantly. These restrictions created logistical headaches for manufacturers that rely on precision alloys and magnets incorporating heavy rare earths.

Against this volatile backdrop, the new agreement signals a tactical retreat by China, at least for now. The general licences to resume exports of rare earths, gallium, germanium, antimony and graphite to U.S. entities will ease a significant chokepoint for American high-tech and defence manufacturers. At a time when the U.S. is striving to rebuild its industrial base and reduce reliance on foreign adversaries for critical inputs, the easing of these export curbs offers a welcome respite.

However, the cautious tone from analysts is well-justified. While the restrictions have been suspended, there is no guarantee China will not reimpose them should its strategic interests dictate it. The underlying imbalance—China’s near-dominance of processing capability and the U.S.’s limited refining capacity—remains unresolved. In fact, just a few weeks prior, China announced expanded controls targeting dual-use technology and exports to defence and semiconductor sectors, underscoring that its leverage is far from relinquished.

From a conservative vantage point, the deal highlights the urgency for the U.S. to accelerate its own domestic critical-minerals infrastructure, diversify supply partnerships with trusted allies, and enhance resilience in its manufacturing supply chains. This moment of concession by China should not lull policymakers into complacency; rather, it should serve as a stark reminder that strategic dependencies on a single foreign actor—especially one with adversarial potential—represent a vulnerability. Better supply-chain security, combined with robust investment in domestic processing, will ensure the U.S. is not caught flat-footed the next time Beijing wields its resource hegemony as a bargaining chip.

In sum, while the rollback is a positive near-term outcome for U.S. industry, it is far from a permanent resolution. Until the structural imbalance in rare earths supply is reversed or meaningfully mitigated, the U.S. and its allies remain exposed to the strategic whims of China. For now, the window of opportunity is open: it is incumbent on the U.S. to act decisively, not merely celebrate the concession.