A severe global RAM supply shortage, driven largely by booming AI data-center demand and memory manufacturers shifting production away from consumer products, is causing dramatic price increases for PC memory, smartphones, laptops, and other electronics, squeezing hobby builders and mainstream buyers alike and potentially suppressing consumer tech markets through 2026 and beyond.

Key Takeaways

• Memory manufacturers like Samsung, SK Hynix, and Micron are prioritizing AI and data-center contracts, diverting DRAM from consumer channels and spiking prices.

• Consumer RAM prices have ballooned—often several hundred percent in months—impacting PC building costs and potentially pushing up prices of phones, consoles, and laptops.

• The RAM shortage is expected to persist into 2026 and possibly beyond, with limited relief as production capacity is focused on high-margin enterprise and AI applications.

In-Depth

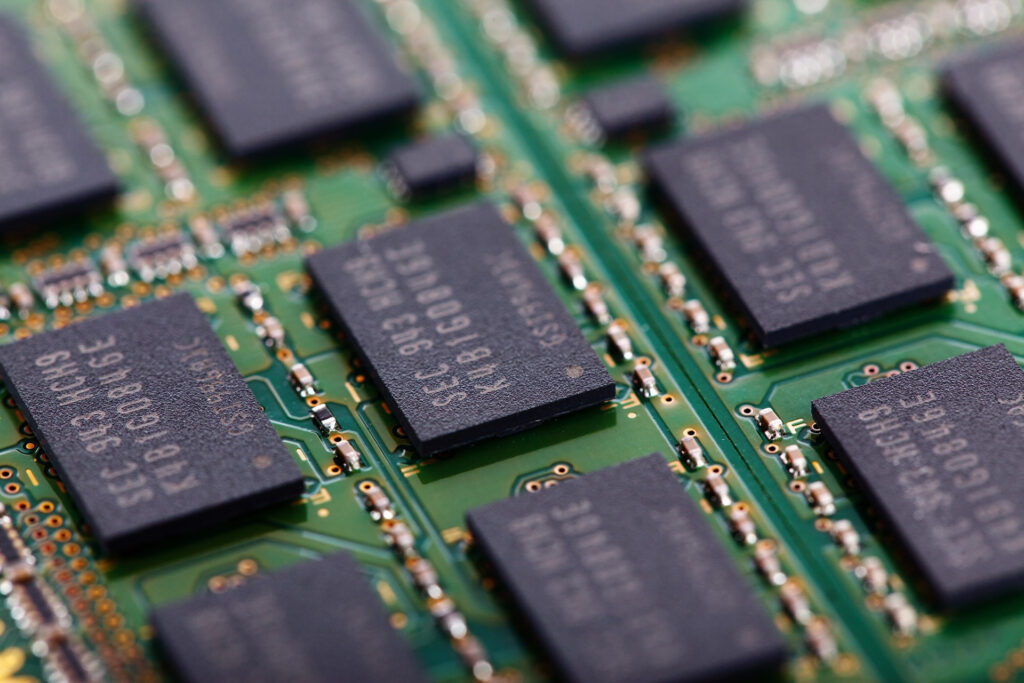

The technology ecosystem runs on memory. Whether it’s a gaming PC, a smartphone, a laptop, or a server farm powering artificial intelligence, all of those devices rely on DRAM and related memory technologies. But a perfect storm of shifting demand, strategic supply allocation, and constrained manufacturing capacity has led to a dramatic imbalance in the global memory market—one that’s now hitting everyday consumers in the wallet.

At the heart of this situation are the world’s major memory producers: Samsung, SK Hynix, and Micron. These three companies together control the lion’s share of the world’s DRAM output. Historically they balanced between selling memory for consumer devices and carving out specialized products for enterprise and server markets. But with the explosive growth in artificial-intelligence workloads—think of the billions of dollars poured into large-scale model training and inference farms—those manufacturers have shifted focus. AI data centers don’t just buy memory; they buy it in gigantic, long-term contracts that guarantee predictable revenue and big margins compared with selling commodity RAM through retail channels.

This reallocation of production has squeezed the pipeline for standard consumer memory modules. Retail and e-commerce platforms are reporting sticker shock: RAM kits that were affordable just months ago are now listed for two, three, or even five times their previous prices. Some smaller shops have stopped posting fixed prices entirely, instead selling memory at “market price” day to day—much like fresh seafood or other volatile commodities. That’s a clear sign of supply instability. And it’s not just a niche problem for PC hobbyists. Because memory is a foundational component, its rising cost feeds directly into the cost of finished devices. Laptops that come with 16GB or 32GB of DRAM are seeing their base configurations get squeezed; smartphone makers, whose profit margins are already tight, are forced to either absorb costs or raise retail prices. Even gaming consoles and tablets feel the squeeze, because they all compete for the same memory supplies.

Some vendors are trying to adapt. A handful of niche RAM manufacturers have released high-end kits with eye-watering prices, and many industry observers are advising would-be PC builders to delay purchases or shift to pre-built systems that bundle memory at a higher price yet hide much of the component cost. Others warn that this is only the beginning: with production capacity largely locked up by AI and enterprise demand, there’s little hope for meaningful relief in the near term.

In practical terms, this means consumers face tough choices. Building or upgrading a desktop PC—a hobby that once offered cost-effective performance—has become an exercise in evaluating whether to spend significantly more or defer purchases until prices normalize. Smartphones and laptops might not see as dramatic a spike yet, but incremental price hikes are already being reported. And since building new fabrication facilities for DRAM takes years and billions of dollars, any genuine increase in supply won’t materialize quickly.

This RAM shortage underscores a broader recalibration in the tech supply chain: one where AI infrastructure, backed by colossal investment and purchasing power, dictates where components go and how much everyday devices will cost. For consumers, that means higher barriers to entry for both affordable tech and cutting-edge performance, at least until the memory market catches up or new competitors and technologies emerge.

If you’re in the market for new hardware, it’s a confusing environment. Waiting for prices to drop might work, but given current trends and the slow pace of capacity expansion, that could take years. On the other hand, buying now means locking in higher costs—but perhaps avoiding even steeper jumps later. Whatever you decide, the ripples of this RAM shortage are already spreading far beyond server farms and into every pocket where memory matters.